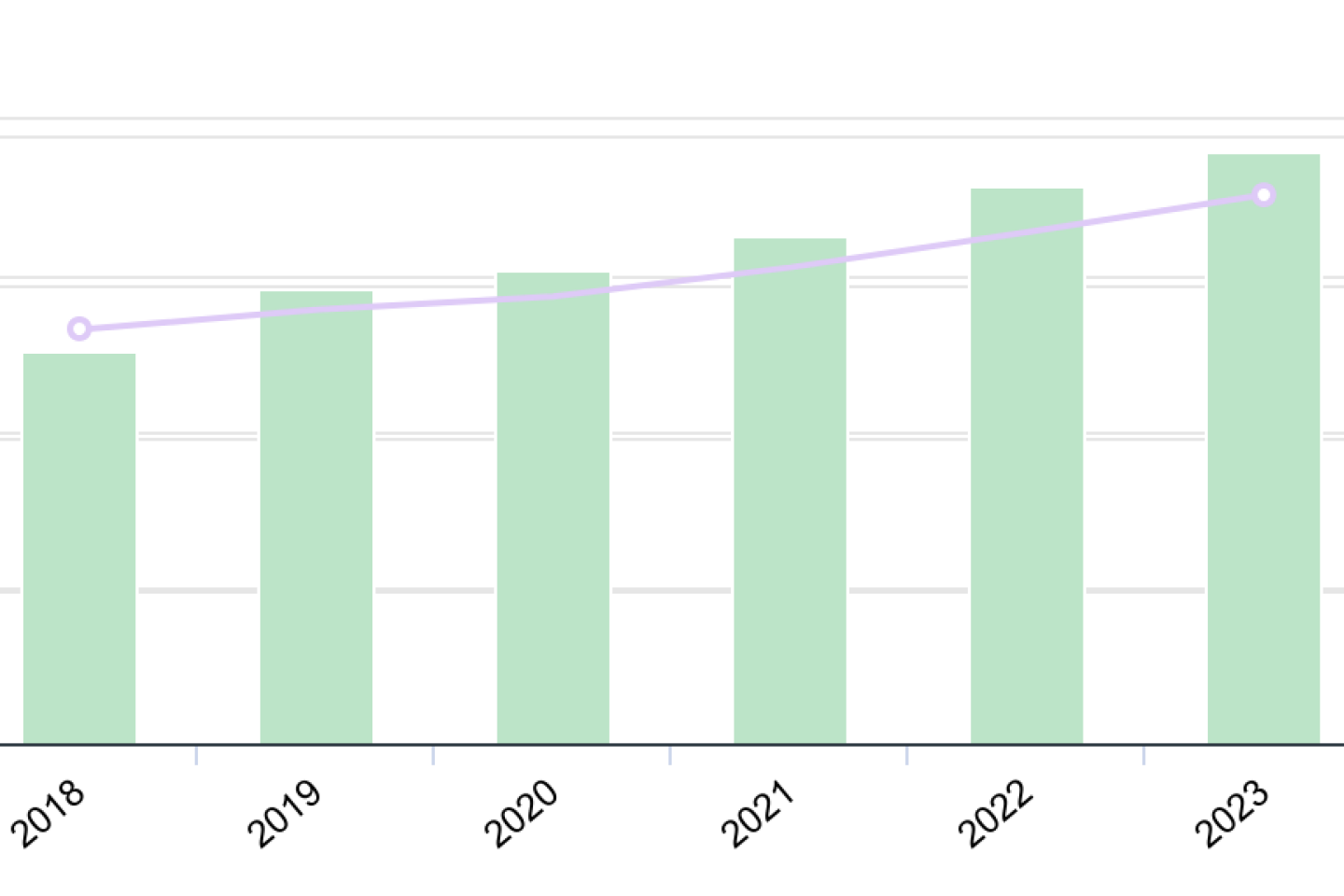

The dynamics observed in previous years continues. In 2023, almost 176,000 households paid real estate tax (IFI), amounting to a total of €1.9 billion.

Data growing by 7.3% and 6.5% respectively compared to 2022, according to the data published by the Directorate General of Public Finances (DGFIP), on April 23, as the 2024 IFI filing deadline approaches for affected taxpayers – the deadlines, end of May or beginning of June, depending on the department, are the same as the tax return. The average amount disbursed decreased slightly, amounting to 11,100 euros (-1.1%).

The IFI, which replaced the asset solidarity tax (ISF) in 2018, applies exclusively to real estate assets. It concerns families with real estate assets (houses, apartments, outbuildings, indirectly held properties, etc.) exceeding 1.3 billion euros net, while its predecessor also targeted financial investments and movable assets (such as jewellery). The main residence, however, benefits from a reduction equal to 30% of its estimated value.

If the replacement of the ISF with the IFI, flagship measure of Emmanuel Macron’s program for the 2017 presidential elections intended in particular to redirect savings towards business financing and to stem tax exile, it has led to a significant drop in the number of taxed families – the DGFIP registered almost 360,000 tax families in 2017, the last year of the ISF’s existence ( for more than 5 billion euros in tax revenue).

70 years on average

In 2023, the taxpayer subject to IFI is on average 70 years old and almost 70% of “IFI families” fall into the age group of 65 years or older – this is the age of the “first-filer” of the family who is taken into consideration. The first tax bracket, made up of taxable amounts between 1.3 million and 2.5 million euros, includes almost three quarters of families who paid the IFI. With an average tax of 5,212 euros, this bracket represents 32% of the tax revenue resulting from this tax.

At the opposite end of the spectrum, 1% of IFI families have assets exceeding €10 million; they paid on average 151,000 euros of IFI in 2023 (compared to 160,000 euros in 2022) and contribute up to 14% of the total IFI collected by the State.

However, the DGFIP notes an increase in the number of families belonging to the “median” brackets (between 2.5 million euros and 10 million euros of net taxable assets). This contributed to the overall increase in revenue related to this system.