Chinese leaders have a taste for suspense. “The measurements will be quite large this time”announced Friday 25 October the Chinese Vice Minister of Finance, Liao Min, traveling to Washington for meetings of the International Monetary Fund and the World Bank. For weeks now, the Chinese authorities have made it clear that a recovery plan is being prepared. If there is a decision, it could be ratified by Chinese Communist Party lawmakers, the National People’s Congress, whose standing committee will meet Nov. 4-8. The scope of the plan is one of the unknowns.

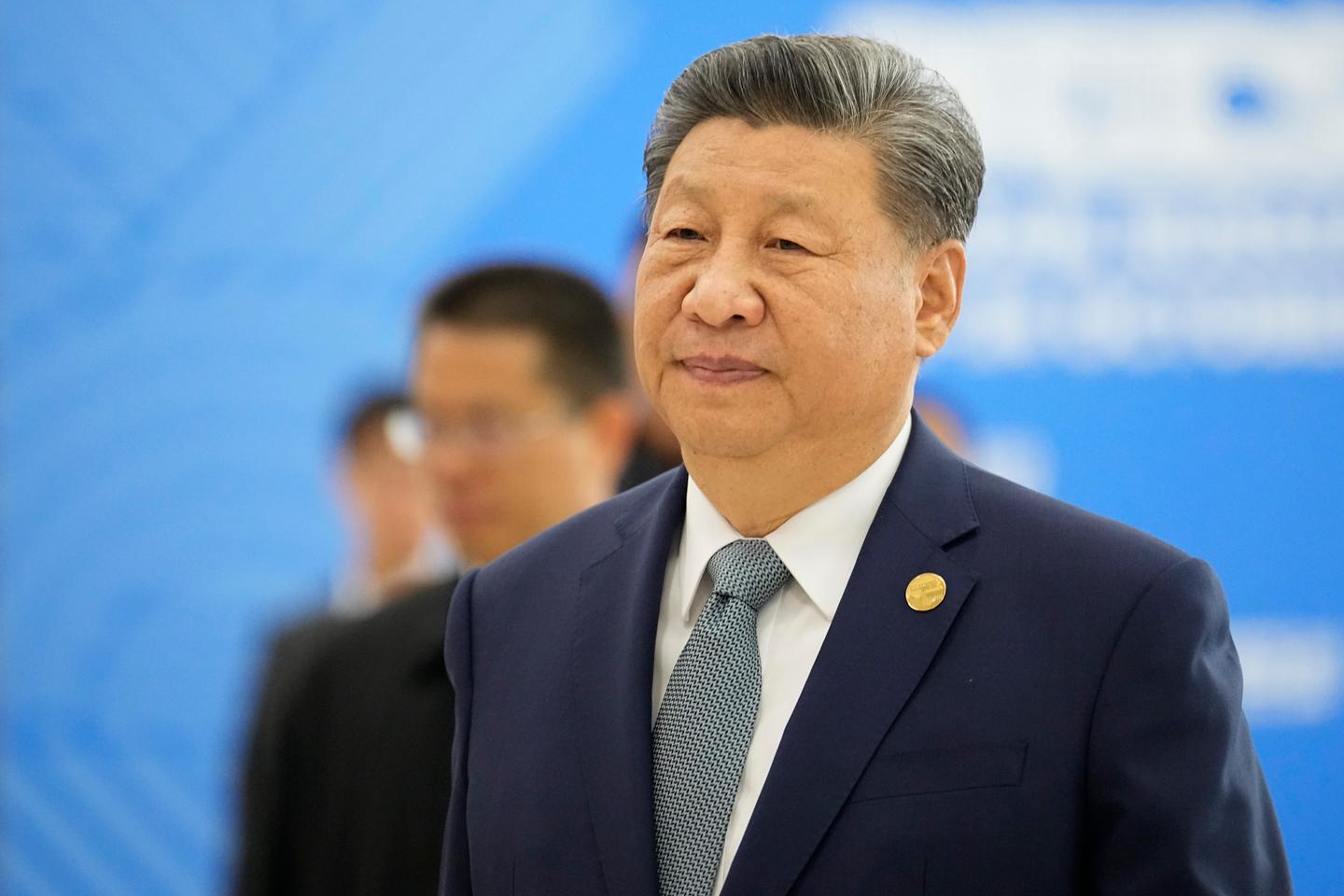

The other uncertainty concerns the sectors of the economy that the government intends to support. The definition of the measures will be an important choice of political orientation, a choice of society. Measures that would strengthen the State, or local governments that are extremely indebted and need to be saved, would further increase the role of Chinese public power, while extensive measures to support consumption would benefit families. The question behind this is who Chinese President Xi Jinping intends to shape. Since September, Beijing announces economic support. This is a sign that something has changed in the perception of economic risk. Until then, the all-powerful head of China’s Party-State, through whom important decisions necessarily pass, seemed quite ready to deal with a dose of economic slowdown.

After all, he had wanted to deflate the real estate bubble, even if the collapse of this sector severely affected families, who invested a large part of their savings in it. But, in the heart of summer,Real estate prices continued to fall and youth unemployment increased from 13.2% in June to 17.1% in July and 18.8% in August. It was becoming increasingly clear that China would struggle to reach its growth target of around 5% this year.

The consumer, largely absent from the plan

Since September, Xi has therefore called on all levels of the administration to do what is necessary to restore growth. The central bank took action by lowering key rates and releasing a credit line to revive the stock market, after a real estate support plan in May, while bond issues were supposed to help bloodless provinces and cities.